There Is More To Improve Your Credit Score

Your credit score is the first thing your bank checks when you apply for a personal loan or home loan. A credit score or credit history is a result of an analysis of a person’s credit files. Other financial institutions, such as insurance companies, phone companies, and government institutions, use credit scores as well.

850credit is one of the best credit repair companies in the United States. When it comes to dealing with creditors, collectors, and credit bureaus, you need experience in this area to get the best results. We have the expertise that you need to deal with any situation presented by creditors, collectors, and credit bureaus. Feel free to read our customers’ reviews.

You may have wondered, “How can I improve my credit score fast?” There are many different ways how to improve credit scores fast, and they can be done in a relatively short amount of time. When you have good credit, it will open up opportunities for you that may not have been available before. For example, if you need a loan or mortgage to buy a house or start a business, having good credit will make the process much easier.

Get started today with a FREE Credit Repair Consultation, or call us at (312) 978-7527

Why Are Credit Ratings Important?

Banks cannot evaluate your ability to repay a loan on time when you fill out an application for a loan. Therefore, credit rating is used to determine your financial strength.

To assess your eligibility, they assess your income, your mortgages, your assets, as well as many other factors. The banks and other money lenders will have a clear idea of your financial situation. A bad credit score makes it very likely that you will be rejected when trying to borrow money.

“Bad Credit” History Reasons

A person can have a bad credit score for a variety of reasons. Mortgage payments missed frequently can harm your credit rating. One of the most common causes of bad credit is being lazy in paying the bills, having a poor financial situation, and overspending.

Each country has its method of assessing a person’s creditworthiness. an individual with a bad credit score may be denied the opportunity to borrow money from a bank. As part of the bank’s policies, this is done to protect themselves from people with low credit scores. You can talk to a consolidation company about easy repayment options on how to improve your credit score fast.

“Bad Credit” Home Loans

A bad credit score does not entirely bar you from obtaining a home loan. Consolidation firms may still be able to lend you money despite your bad credit score. You do not have to worry if the bank rejects your loan application if you want to close on a house you like.

A consolidation firm will analyze your financial records and grant you a loan based on certain terms and conditions. An individual with a poor credit rating would usually have to pay a higher interest rate than someone with good credit scores.

You have a higher chance of improving your credit scores as you make regular payments. Even if you have poor credit, you can still borrow money with an asset since your asset will serve as collateral, not your credit score. Such a loan is called a secured loan. Despite not owning an asset, you may still qualify for an unsecured loan that is subject to certain conditions.

You cannot get certain loans, credit cards, and other financial aid if you have a bad credit score. Low credit scores affect how much you can be approved for and at what rate, potentially making your loan much more expensive. They can be improved, and you can even learn how to raise your credit score 100 points overnight.

How To Boost Credit Score Fast

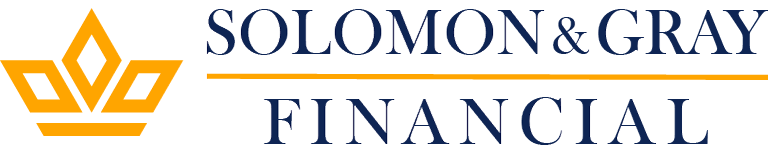

There are a few things you can do to raise your credit score in a short amount of time.

- Immediately pay off any late bills. One way is by ensuring that you always pay your bills on time, every month. Make sure you pay your bills on time.

- Maintain a credit balance below 30%. You should also keep your debt levels low and avoid maxing out your credit cards.

- Avoid closing old credit accounts. Closing old accounts will not help your score and may even hurt it, so don’t do this unless there is an emergency. Secure your credit card.

- Obtain credit monitoring services. Another way to improve your credit rating is to get a copy of your credit report and check for any mistakes.

- Resolve credit report errors. If you find any errors, make sure to dispute them with the bureau immediately.

- Obtain rent and utility payment records. Lastly, try to establish a good payment history by using credit counseling services or by enrolling in a Debt Management Plan (DMP).

How To Increase Credit Score To 800

There are many methods to increase your credit score, but it will depend on how bad your current rating is.

1. Contact The Major Bureaus And Rebuild Or Build Your Credit History

The first thing you should do if you want to improve your credit score is contacted the three major bureaus (Equifax, Experian, and TransUnion) that store information about you. They will be able to give recommendations based on what they know of your financial situation as well as alert them in case there have been any errors made while recording data about you.

2. Make Sure You Pay Your Bills On Time Or Show Intent Of Payment

If a person wants their credit scores increased immediately then they need to call each creditor from which he or she has borrowed money intending to pay off those debts which have high-interest rates before transferring all balances onto one card so that it can become easier to keep track of. Creditors often like it when borrowers do this as it makes them appear more reliable and responsible, which are two qualities creditors look for in loan applicants.

3. Maintain A Low Credit Utilization Rate And Dispute Unauthorized Use

If you have any credit inquiries that were not authorized by you, contact the bureau immediately and dispute the charge. Doing so could potentially improve your credit score because unauthorized inquiries can negatively impact your rating.

4. Review Your Credit Report And Score

Keep updated on your credit score rating regularly using service tools or apps that are trending in the market, so you are always aware of what steps still need to be taken to increase your score even further.

Aim for an 800 credit score if you want a credit score that’s above average. Even though this is not the highest credit score possible, it puts you in the highest credit scoring range for the FICO credit scoring model. The risk of lending to borrowers with this credit score range is typically the lowest. Due to this, if a lender approves you, chances are you’ll be able to secure the most favorable terms, such as the lowest interest rate.

Your credit score is the most important number in your financial life. It can determine whether you get a loan, where you live, and what jobs you qualify for. If it’s not high enough, good luck with even renting an apartment or buying a car! We’ll break down how to increase your credit score fast so that everything else will fall into place.

We are ready to help you how to raise your credit score fast! Get started today with a FREE Credit Repair Consultation, or call us at (312) 978-7527